Croatia Holiday Home Insurance

- Tailor your Croatia holiday home insurance cover to suit your lifestyle

- Offers peace of mind to enjoy the leisure time you have earned

- 24/7 Croatia holiday home insurance emergency claims service

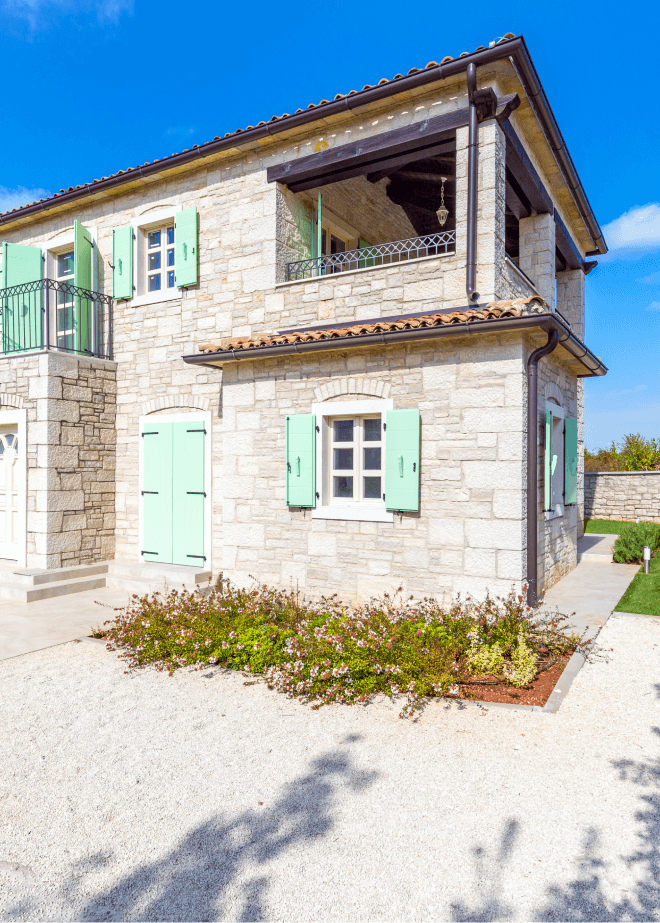

Croatia Holiday Home Insurance

Croatia offers a unique combination of breath-taking beauty and rich cultural legacy. The dream-like sapphire waters of the coastline are undeniably the primary source of fascination for many tourists. This country also offers numerous urban beauties that may have attracted you to buy a second home here.

If you own a holiday home in Croatia, Intasure can help by providing cover for your property all-year-round. Insurance for Croatian holiday homes can help to provide financial protection for your property overseas

Our Partners

Intasure works with an established partner to provide flexible insurance options.

Which Countries Are Covered By Holiday Home Insurance?

Our holiday home insurance abroad covers many common British tourist destinations, such as France and Spain. Looking to go somewhere further afield? We also offer policies for more exotic locations, such as Turkey.

-

View a list of countries we cover

What Our Customers Say About Us

Second Homes In Croatia

Buying a holiday home is rarely a small investment, which is why many want to make sure their property is protected, whether it’s based in Croatia or any other country abroad. Intasure helps our customers look after their second homes with a range of insurance policies.

Benefits of Intasure’s overseas holiday home insurance include:

-

Emergency travel expenses after making an insured claim

-

Temporary accommodation after making an insured claim

-

Protection against damages caused during short or long term lettings

What Property Types Can Intasure Cover In Croatia?

Intasure offers cover for a broad range of Croatian properties, including:

-

Townhouses

-

Villas with pools or hot tubs

-

Flats and apartments

Flats and apartments

Why Choose Intasure For Your Holiday Home?

As a relatively new form of renting, many budding landlords may need more information about what cover is available before renting out an Airbnb property, which is where we can help.

Benefits of using Intasure for your holiday home insurance:

-

Customers can tailor insurance to their needs with optional covers

-

Up to £1 million buildings cover and £5 million public liability cover

-

Cover for short and long-term lets

-

Cover whether the property is occupied or not, for up to 60 days

-

Emergency travel costs for insured claims

-

Loss of rent cover following an insured claim

-

Alternative accommodation costs for insured claims

Policy Documents

View our policy documents to discover the cover Intasure can provide.

View and Download